Understanding your Tax Bill

Learn how to interpret your tax bill! The Understanding your Tax Bill example notes all sections of your bill and explains what they mean.

How do I pay my Tax Bill?

Online Banking/Telephone Banking

For Online Banking – add a payee and search for Sables-Spanish Rivers (TWP) Tax. Your account number is your 19 digit roll number: 5218 000 XXX XXXX 0000 found on your tax bill. Tax payments can only be posted to the properties as identified in the internet banking forms and/or remittance forms. If you have multiple properties, payments must correspond to the appropriate roll number. Please be advised that it may take between 1 – 5 business days before your payment is received.

At your financial institution (bring your tax bill).

Cheque or Money Order via mail or deposited in the drop box outside the Municipal Office front door during the hours of 8:00am – 4:00pm. Please be sure to include your payment stub from your tax bill or identify which roll number your payment should be applied to. A receipt will be mailed for all payments processed from the drop box.

Credit Card **only through third party provider** a convenience fee does apply. Please find at E-Billing/E-Payment Service.

NEW Pre-authorized Payment Plan Option Available

You can enroll in an automatic payment plan where the amount is withdrawn from your bank account at regular intervals throughout the year or on the billing due date. Download the Preauthorized form and submit your completed form at the Municipal Office using the drop box in front of the Municipal Building or by mail or email to inquiries@sables-spanish.ca

If you wish to discuss your payment options please call the Township Office at 705-865-2646 we are happy to assist you.

Municipal Property Taxes

Property Taxes are due on the last business day of February and September of each year. A prompt payment of your account will be greatly appreciated. Penalty will be added to your account at a rate of 1.25% on the balance of any unpaid taxes on the first day of each month thereafter.

You can view a copy of the 2024 Taxation Bylaw .

Property taxes are calculated from assessed property values issued by the Municipal Property Assessment Corporation. For more information on how assessment works, market trends, the Request for Reconsideration process and property assessment and taxation, visit aboutmyproperty.ca. If you would like to see the information MPAC has on file for your property or compare your property to others in your area, you can register and login using the Roll Number and Access Key located on your Property Assessment Notice. Your deadline to file a Request for Reconsideration is listed on your Property Assessment Notice. You have 120 days from the Issue Date listed on your Notice to request a review.

If you do not agree with the assessed value of your property, you have the right to file a complaint with the Assessment Review Board (ARB), which is an administrative quasi-judicial tribunal of the Province of Ontario. Please contact MPAC (Municipal Property Assessment Corporation) for more information.

For basic property information and assessed values for Ontario properties, visit the Municipal Property Assessment Corporation (MPAC) website at http://www.mpac.ca/ .

Municipal Property Assessment Corporation- School Support Portal

The Municipal Property Assessment Corporation (MPAC) has updated the Application for Direction of School Support (ADSS) form on the Changing Your School Support page on mpac.ca. The Application for Direction of School Support (ADSS) form can be viewed here.

2024 Budget

2023 Budget

2024 Budget Highlights:

Comparison of Tax Rates 2024 & 2023

2023 Financial Statements

2022 Financial Statements

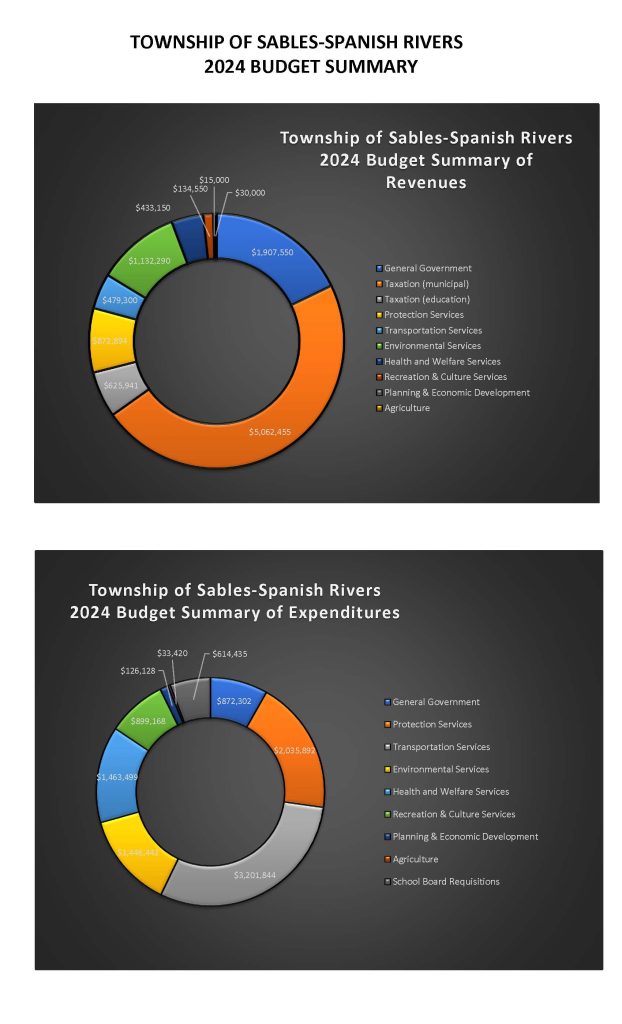

2024 Budget Summary of Expenditures & Revenues:

Co-Operative Purchasing

LAS Group Buying CFTA Compliance

To help maximize the Township’s economies of scale, we participate in the following operative purchasing groups:

Finance Committee

The Finance Committee meets on an as needed basis in Council Chambers at 11 Birch lake Road, Massey ON. View the Finance Committee Terms of Reference here.

Committee Members:

Chair: Kevin Burke

Councillor: Casimir Burns

Councillor: Harold Crabs

Councillor: Edie Fairburn

Councillor: Merri-Ann Hobbs

Councillor: Cheryl Phillips

Councillor: Mike Mercieca

Edith Mercieca

Brent St. Denis

Contact Ruth Clare for more information

Email: rclare@sables-spanish.ca

Phone: 705-865-2646